Latest Features

More Stories

Universal Pictures has released a brand new Love Hurts BTS video for its upcoming action thriller, starring Oscar winner Ke…

Warner Bros. Discovery has announced the Waitress: The Musical Max streaming release date, revealing when the hit Broadway play will…

M. Night Shyamalan and Apple are being sued for $81 million over alleged copyright regarding the television series Servant. Created…

Netflix has shared the official Apple Cider Vinegar trailer for its upcoming limited drama, starring Kaitlyn Dever (Dopesick, Unbelievable) and…

Ridley Scott has decided it’s time to “move on,” at least for the time being, from his Bee Gees biopic.…

Amazon has officially set the Red One 4K & Blu-ray release date, revealing when fans can bring home the Dwayne…

Supernatural vet Jared Padalecki has officially found his next project with Walker showrunner Anna Fricke in the form of an…

The runtime for Captain America 4 has been revealed. Releasing in February 2025, Captain America: Brave New World will be…

Warner Bros. has finally announced the We Live in Time Max release date for A24‘s latest romantic comedy-drama, starring Academy…

Today, 2K and HB Studios revealed PGA Tour 2K25. Gracing the cover are decorated golfers Matt Fitzpatrick, Max Homa, and…

Star Wars: Skeleton Crew creators Jon Watts and Christopher Ford have some ideas for a second season. Star Wars: Skeleton…

Universal Pictures and Blumhouse have released the first The Woman in the Yard trailer, previewing the upcoming horror movie about…

Steven Spielberg convinced Ke Huy Quan that he should star in the new action comedy movie Love Hurts. Love Hurts…

Good Deed Entertainment has shared the official Three Birthdays trailer for the upcoming romantic drama, starring Josh Radnor (How I…

A new Screamboat photo previews David Howard Thornton’s role as the terrifying Steamboat Willie from the upcoming horror movie based…

The first trailer for The Alto Knights has been released. The Alto Knights is a new biographical crime drama movie…

Sony Pictures has finally shared the Until Dawn first look video for its highly-anticipated live-action adaptation of the hit horror…

Supergirl: Woman of Tomorrow has begun filming. Supergirl: Woman of Tomorrow is a forthcoming DCU movie that is expected to…

The release date of the Demon Slayer: Infinity Castle movie has been revealed through a recent listing. The movie based…

Netflix has shared The Witcher: Sirens of the Deep trailer for its newest animated movie, which will be led by…

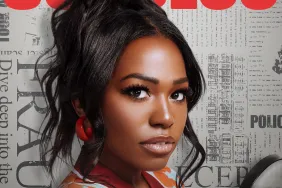

ComingSoon is excited to debut the exclusive Scam Goddess clip from the upcoming Freeform show, which will be hosted by…

Netflix has added Sophia Anne Caruso (The School for Good and Evil), Mark Penwill (Catch Me a Killer), and Anton David Jeftha (Dominion) to the…

Netflix has shared the full Back in Action trailer for its upcoming action comedy movie, led by Jamie Foxx and…

Sara Bues’ Nina Chapman serves as an important character in several seasons of the long-running NBC police drama series Chicago…

Ben Stiller is in discussions to return for a new Meet the Parents sequel, along with original cast members Robert…

Reviews and Previews

The three-year wait is over as Severance returns to Apple TV+ for its sophomore season later this month. While many…

Alfred Hitchcock is often regarded as one of the greatest filmmakers to ever step behind the camera, and his title…

Christmas movies come in all shapes and sizes. Whether they’re the family movies you watch at home alone or the…

The horror genre is always looking for ways to innovate, new approaches, or a different perspective when doing classic stories,…

Interviews

Shifting Gears stars Maxwell Simkins and Barrett Margolis spoke to ComingSoon Editor-in-Chief Tyler Treese about the new ABC sitcom. The…

ComingSoon Senior Editor Brandon Schreur spoke to Gerard Butler and O’Shea Jackson Jr. about Den of Thieves 2: Pantera. Butler…

Shifting Gears star Tim Allen spoke to ComingSoon Editor-in-Chief Tyler Treese about his new ABC sitcom. The hilarious show, which stars…

ComingSoon Senior Editor Brandon Schreur spoke to Jayden Bartels and Sam McCarthy about Goosebumps: The Vanishing. Bartels and McCarthy discussed…